|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

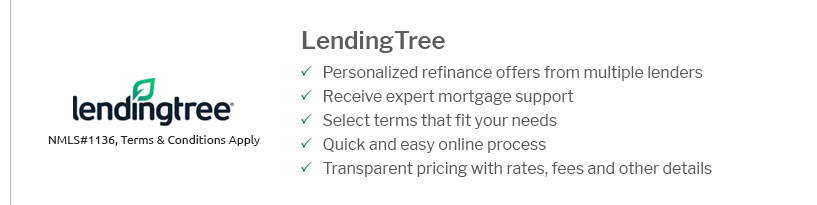

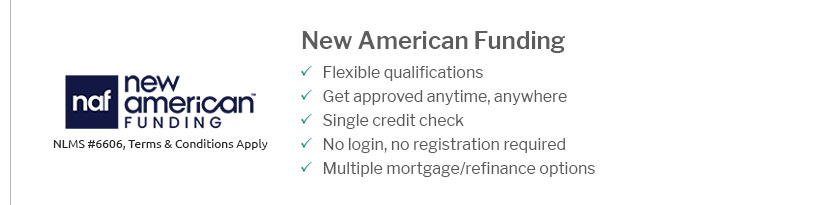

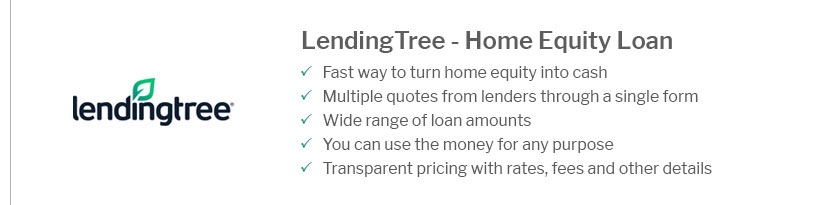

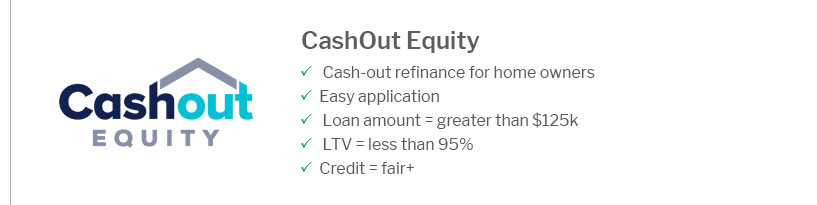

Understanding the Best Reputable Mortgage Refinance CompaniesRefinancing your mortgage can be a strategic move to lower your interest rates or modify loan terms. Choosing the right refinance company is crucial to ensure a smooth process and favorable outcomes. In this article, we will explore the top reputable mortgage refinance companies, their benefits, and what to consider before making a decision. Top Reputable Mortgage Refinance CompaniesWhen looking for a reliable mortgage refinance company, consider the following top-rated options:

Key Benefits of RefinancingRefinancing can bring several advantages:

For more insights, explore the reasons to refinance your home and see how it could benefit you. Factors to Consider When Choosing a Refinance CompanyIt's important to evaluate these factors: Interest Rates and FeesCompare different companies to find competitive interest rates and understand any associated fees. Look for transparency in cost structures. Customer Service and SupportQuality customer service is essential. A company that provides excellent support can make the refinancing process seamless and stress-free. Loan OptionsDiversified loan offerings allow you to choose a product that best fits your needs. Consider whether a company offers fixed, adjustable, FHA, or VA loans. If you’re considering moving from an FHA loan, learn how to refinance FHA loan to conventional and explore your options. FAQsWhat is mortgage refinancing?Mortgage refinancing involves replacing your current loan with a new one, often to secure better terms or rates. How do I choose the best refinance company?Consider factors such as interest rates, customer service, loan options, and company reputation. Comparing multiple companies can help you make an informed decision. Can refinancing save me money?Yes, refinancing can reduce monthly payments, lower interest rates, and allow you to access equity, leading to potential savings. https://money.usnews.com/loans/mortgages/mortgage-refinance-lenders

A mortgage refinance replaces your original mortgage with a new one, ideally with a lower interest rate. You'll get a new interest rate and other loan terms. https://money.com/best-mortgage-refinance/

With its high lending cap and lack of lender fees, Ally Financial is our pick for the best mortgage refinance company for jumbo loans. https://www.nerdwallet.com/best/mortgages/refinance-lenders

Best Mortgage Refinance Lenders of January 2025 - Our 2025 Best-Of Award Winner - Best Mortgage Refinance Lenders of January 2025 - Explore all ...

|

|---|